"XRP's $2 Crash: Will Bullish Trends Emerge for BTC and ETH?"

XRP's $2 Crash: Analyzing Potential Bullish Trends for BTC and ETH

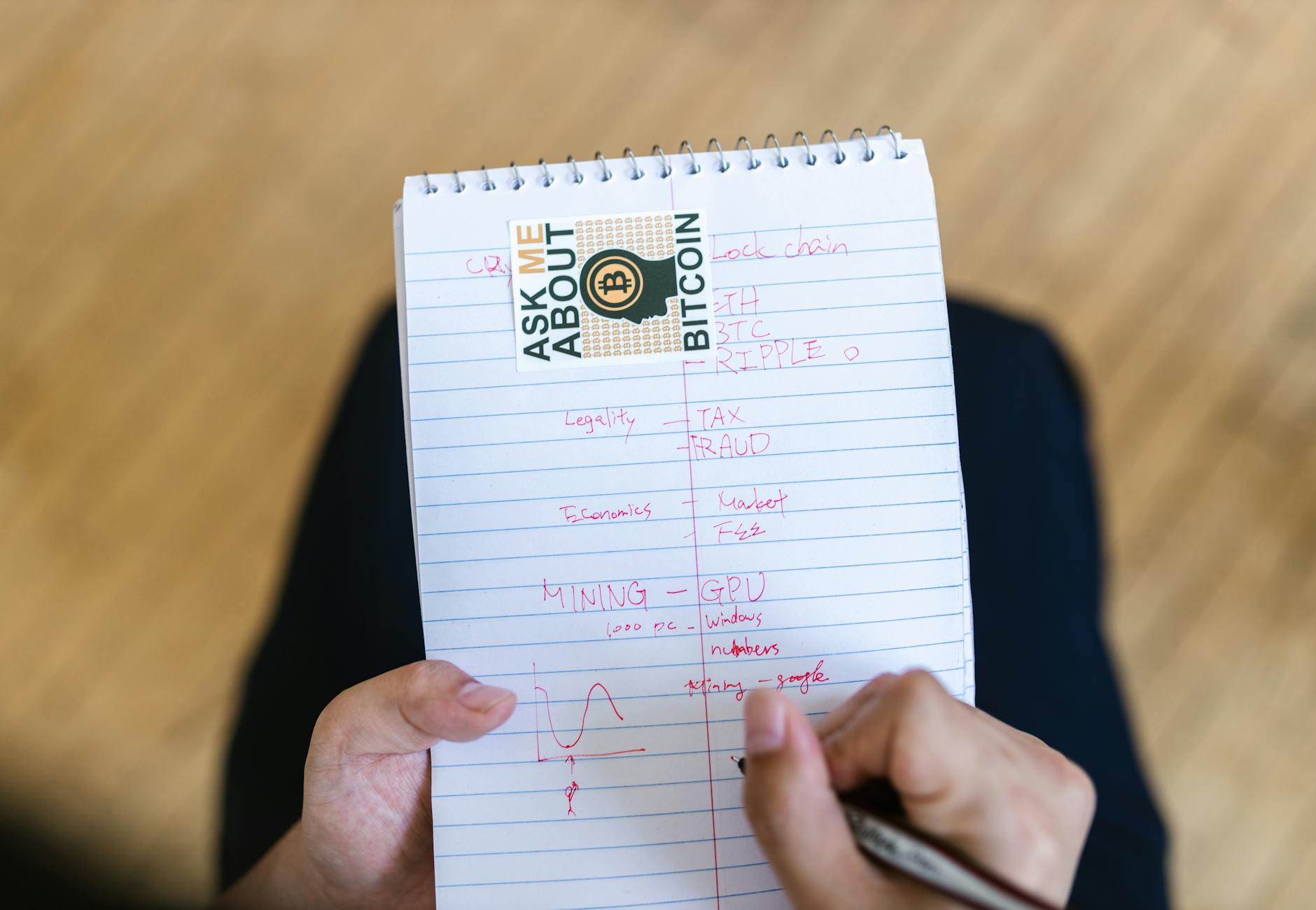

Market Overview

The cryptocurrency market experienced significant turbulence recently, highlighted by XRP's sharp decline to the $2 mark. This sudden drop has raised questions about the overall health of the crypto ecosystem and the potential ripple effects on major players like Bitcoin (BTC) and Ethereum (ETH).

As investors analyze the implications of XRP's crash, many are looking for signs of recovery and bullish trends in BTC and ETH. Understanding the current market dynamics is essential for making informed investment decisions.

Key Developments

The recent downturn in XRP can be attributed to a combination of market sentiment and regulatory concerns. XRP's price plummeted amid fears of increased regulatory scrutiny, which has historically affected the broader crypto market. As XRP struggles, BTC and ETH have shown varying degrees of resilience.

Specific Market Observations

Despite XRP's decline, BTC has remained relatively stable, fluctuating around its support levels. ETH, on the other hand, has witnessed a slight uptick, suggesting investor confidence in its long-term fundamentals.

Technical Analysis

Technical indicators reveal a mixed outlook for BTC and ETH post-XRP crash. Key resistance levels have emerged, and traders are keenly watching for breakout signals. Volume analysis indicates a potential accumulation phase for BTC, while ETH's price action has shown promising bullish divergence.

Technical Insights

For BTC, the next critical resistance level lies above $30,000, while ETH is testing its support around $2,000. Monitoring these levels will be crucial for traders looking to capitalize on potential bullish trends.

Future Implications

The implications of XRP's crash extend beyond immediate price movements. Market sentiment is shifting, and both BTC and ETH could benefit from renewed interest as investors seek safer assets. Regulatory clarity in the coming months will also play a pivotal role in shaping future trends.

Expert Perspectives

Market analysts suggest that BTC and ETH may emerge stronger from this situation. With institutional interest in digital assets growing, the potential for a bullish trend remains intact. However, caution is advised as external factors, such as regulatory developments, could impact market direction.

Conclusion

As XRP grapples with its recent crash, the crypto community is left to ponder the potential bullish trends for BTC and ETH. Key takeaways include:

- Watch key resistance levels for BTC and ETH to gauge market sentiment.

- Monitor regulatory developments, as they could significantly impact market stability.

- Consider the potential for accumulation in BTC and ETH as investors seek stability.

In summary, while XRP's crash is concerning, it also presents an opportunity for BTC and ETH to solidify their positions in the market. By staying informed and vigilant, investors can navigate this volatile landscape effectively.

This article has been thoughtfully curated and expanded upon based on the original news piece, offering a more detailed and accessible reading experience. You can refer to the original article here.